How AI Personalized Video Builds Trust and Increases Upselling in Insurance?

Published on 2025-06-11

In the insurance sector, upselling happens when policyholders are given the option to increase their policy or get even better services. As customer acquisition becomes increasingly costly and competition intensifies, focusing on retaining loyal customers has become a more effective strategy. Because of personalized AI video, companies can provide offers to their customers at the right time, considering their particular needs and requirements.

It contributes greatly to making customers satisfied with the services. Proper and timely upgrades for policyholders make them feel appreciated and well understood. Such caring efforts encourage people to stay loyal to the brand for a longer time. Now, empathy can be used in video communications because of AI.

How Does Personalized AI Video Influence Upsell Outcomes?

Insurance companies make their communication more effective by tailoring AI video content to each person’s interests and actions. Rather than delivering the same set of information in brochures, insurers use messages that speak to each person. They can include images of the customer’s particular policy, recommended add-ons, and reasons supported by evidence for the changes.

It allows people to grasp the information better and decide wisely. Recognizing customers and making them feel valued through personalization is what important customer engagement is all about. Customized videos work better for users. Videos tend to attract more attention from people than long texts. Videos make it easier for people to understand complicated details of different policies. This leads to being sure with decisions and making conversions faster.

Besides sales, you should also focus on earning the trust of your customers. Customers are usually more willing to take part, choose higher tiers, and return if you recognize their needs.

How Can Online Video Communication Personalize the Insurance Journey?

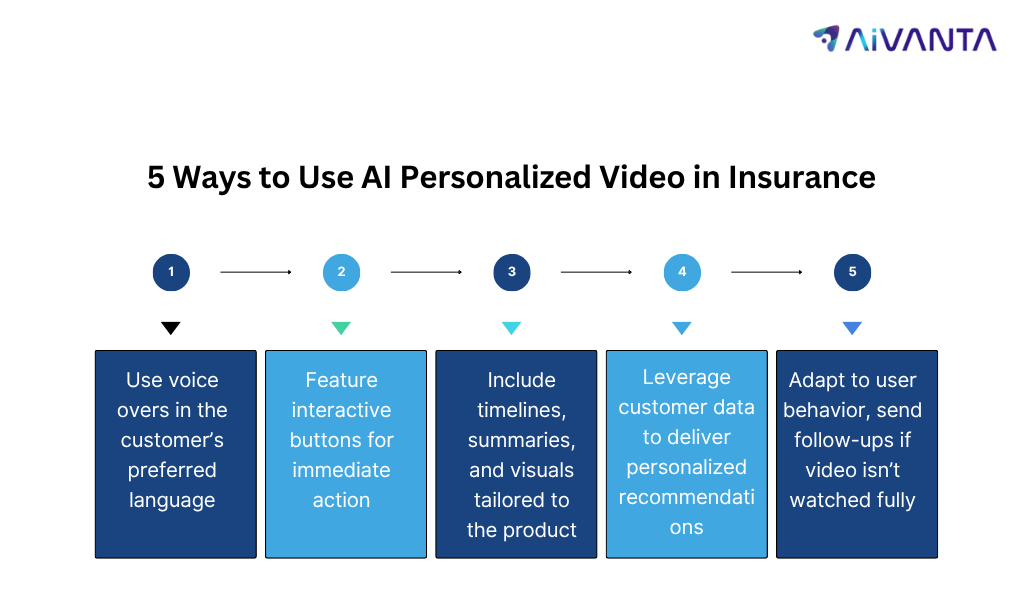

Online video communication offers insurers the chance to replicate a human conversation, digitally. Whether it’s through WhatsApp, email, or mobile apps, AI-generated videos can guide policyholders through complex information from premium comparisons to claim procedures. These videos:

Customers receive the right message at the right time without waiting in call queues or navigating difficult portals.

What Role Does AI Play in Improving Insurance Customer Experience?

AI shifts the way insurers engage with people at each stage of the policy until it ends. No matter if the client goes through onboarding or deals with claims, upsells, or renewals, AI makes sure every action is relevant to them. It leverages behavior data, product preferences, and engagement metrics to shape messages that are timely and helpful.

Also, it allows for continuous learning. By noticing what users do with the content, insurers can boost their communication efforts. With these improvements, your messages can always include the topics that interest your clients the most. Hence, better insurance customer experience equals stronger upsell potential.

Also Read: Life Insurer Boosts Conversions 8% with Personalized Policy Videos

Why Are Loyalty Programs Critical for Upselling in Insurance?

The value for personalized loyalty programs in insurance encourages loyal customers to endorse the company. When combined with tailored upsell offers, the impact is exponential.

Imagine a loyalty platform that tracks wellness milestones, policy anniversaries, or claim-free years. Based on this, it sends personalized AI video messages for customer engagement offering bonus coverage, early renewals, or premium discounts. Loyalty-driven upselling shifts the focus from selling to relationship-building. Customers view upgrades as rewards, not pitches.

How Do Tailored Videos Drive Faster Lead Conversion?

AI generated videos are digital advisors that create clear directions for potential clients dealing with insurance. These videos engage viewers from the moment of inquiry, using their name, needs, and risk profile to propose tailored policies and solutions. They speed up getting customers to buy by making the process less complicated and easier to understand. In every video, you get clear steps to either purchase a policy, talk to an advisor, or grasp how premiums are structured.

These videos also help overcome inertia. Many customers hesitate due to a lack of clarity or time. A video that answers common concerns and walks them through the next steps significantly reduces decision fatigue. It transforms passive leads into confident, active policyholders.

One insurer using video lead generation saw a 45% improvement in quote-to-policy conversion. The key? Timeliness, relevance, and visual clarity.

Conclusion

AI has redefined upselling in insurance by making it more relevant, timely, and human. Personalized video messaging ensures that each customer interaction is meaningful, elevating both the experience and the conversion. Moreover, upselling video communication turns insurance from a transaction into a relationship. When done right, it adds value to the customer's life while increasing revenue predictability for the provider. This dual benefit is what makes it such an essential part of modern insurance marketing. AiVANTA enables smarter upselling in insurance through a suite of AI-driven video solutions.