How Can Data-Driven Personalization Help Retain Insurance Customers?

Published on 2025-08-13

In the current business environment, insurance companies face intense competition, they must ensure that they maintain the satisfaction of customers so that they don’t defect to another company. Data-driven personalization refers to giving each customer messages and offers with reference to their needs based on the information about that customer. Rather than sending the same message to everyone, a company can use data on customers' past behavior and history to send the right message at the right time.

Personalization is not an option anymore, but a necessity, especially to a company which aims at retaining customers. Once you are in a position to anticipate the needs of a customer therefore, helping them earlier, chances are that they will renew their policy and last longer.

Can Data-Driven Strategies Keep Insurance Clients Loyal?

Keeping customers starts with knowing their habits. Checking their usage, payment history, claim records, and how they like to be contacted helps insurers send the right messages. When customers get messages they care about such as renewal reminders or policy updates they are more likely to stay. Companies can send a personalized AI video showing the customer’s coverage, new benefits, and a loyalty discount for renewing early. By watching for signs like late payments or less engagement, insurers can contact customers early with offers or extra help. Old marketing methods fail because they treat every customer the same. With data, insurers can group customers and talk about their exact needs. Customers who feel understood are more likely to stay, renew their policy, and buy extra services.

How Can Automation Make Personalization More Effective?

AI marketing automation can send personalized messages to many customers at once. These tools use data and AI to create messages without manual work. Automation makes sure the message is clear, sent on time, and works well for digital customer engagement, which helps build trust. Automation can send payment reminders, renewal notices, or claim updates in different languages for each customer.

Also Read: Life Insurer Boosts Conversions 8% with Personalized Policy Videos

How Does Personalized AI Video Transform Communication?

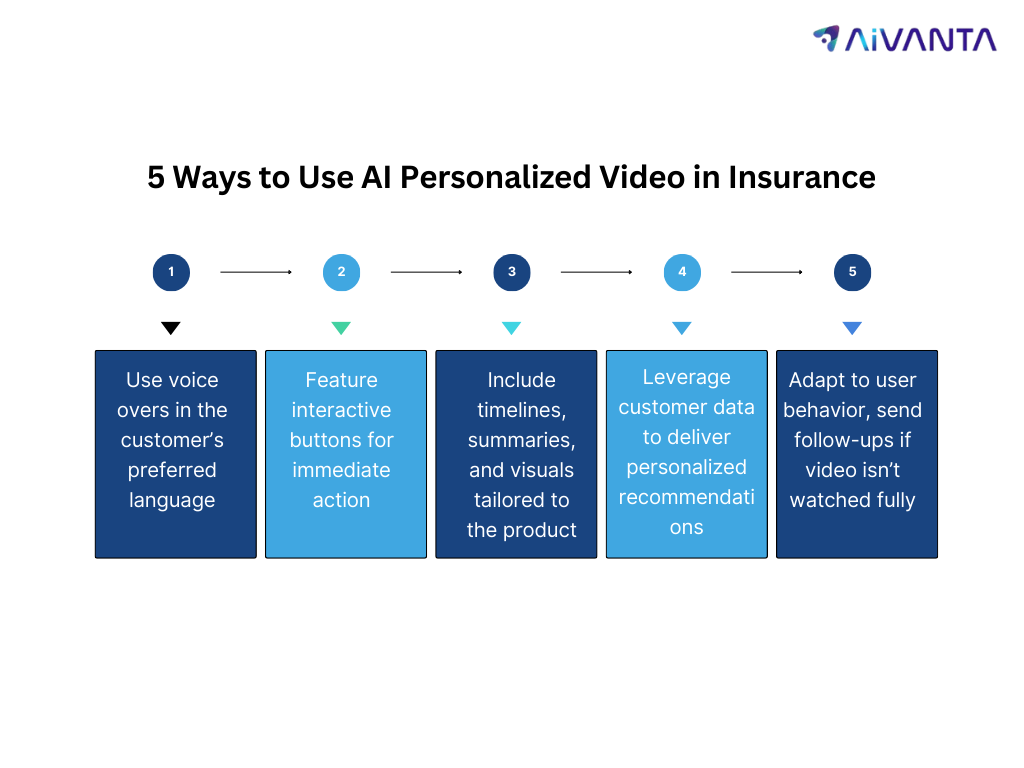

Videos grab attention, personalized AI video can use customer details such as name, policy info, and history to create a special message just for them. This makes communication more friendly and helps explain important information clearly. Explaining policy details, claim steps, or benefit changes is easier and more effective with videos and voiceovers. AI can create thousands of personalized videos quickly without manual work.

Digital customer engagement ensures speaking to customers through email, social media, apps, and videos in a way that feels personal and on time. Data shows where customers spend most of their time so insurers can focus there. Loyalty programs and offers can be made to fit each customer’s history, increasing success.

Why Is Multilingual Voiceover Key to Retaining Customers?

Multilingual voiceover means speaking to customers in their language. In diverse markets, this makes customers feel valued and understood. When you mix multiple languages with data-driven personalization, you remove barriers, make customers feel included, and build loyalty. Speaking a customer’s language shows respect and care, which increases trust. Using multiple languages helps insurers connect with more people and stay active in different regions.

How Can You Measure the Impact of Personalization?

Insurers ought to monitor the level of policy renewal, levels of engagement, and customer satisfaction scores in order to determine whether personalization is working. As an example, the direct impact will be indicated by comparing the renewal rates in pre-launch and post-launch periods of running personalized AI video campaigns. Constant evaluation of such outcomes will enable the insurance providers to streamline their processes and enhance personalization further to the point at which it becomes a necessary component in each consecutive period of time, and to continue expanding their customer base with loyalty.

One big benefit of personalization is better return on investment (ROI). Sending the right message to the right person saves money and brings better results. Personalized campaigns work better, leading to more renewals and sales. AI marketing automation saves time and lets teams focus on important work.

Real Results of Personalization in Insurance

- 45% more renewals after starting personalized renewal videos

- 60% higher engagement with multilingual, data-based messages

- 30% fewer cancellations using prediction models

A life insurer used personalization and multilingual automation, cutting policy lapses by 50% and a health insurer used AI videos to explain coverage benefits, increasing retention by 35%.

How Will Personalization Shape the Insurance Industry?

The future will bring better AI, better prediction tools, and real-time personalization. Companies will adjust messages instantly based on customer changes. Messages will change in real-time based on activity, location, and likes. Combining voice in many languages with AI video will make communication feel natural.

Overcoming Common Challenges in Personalization

Although data-driven personalization results in powerful outcomes, the insurers can be affected by unfinished customer data, the aged system, or the issue of privacy. To break them, companies should have good information management processes, data security and updates on customer data. Transparency in data usage and clear privacy policies trust as well. With the accuracy and the security of data, insurers will be assured of being in a position to convey relevant, timely, and useful messages without compromising the customer trust.

Conclusion

In insurance, trust and long-term relationships are key. Data-driven personalization is a proven way to keep customers. By using data, automation, and personalized AI videos, insurers can create journeys that feel personal, friendly, and valuable. The result? More renewals, stronger loyalty, and happier customers. Request a demo today to see how it can work for your business.