How Can Personalized AI Video Enhance Customer Experience in Banking?

Published on 2025-06-25

Customers in the banking industry today are not just looking for banks that offer error-free transactions and mobile access; they want banks that provide personalized service, responsive support, and clear communication. A good customer banking experience is no longer optional; it’s something banks must provide to keep customers happy, build loyalty, and encourage referrals.

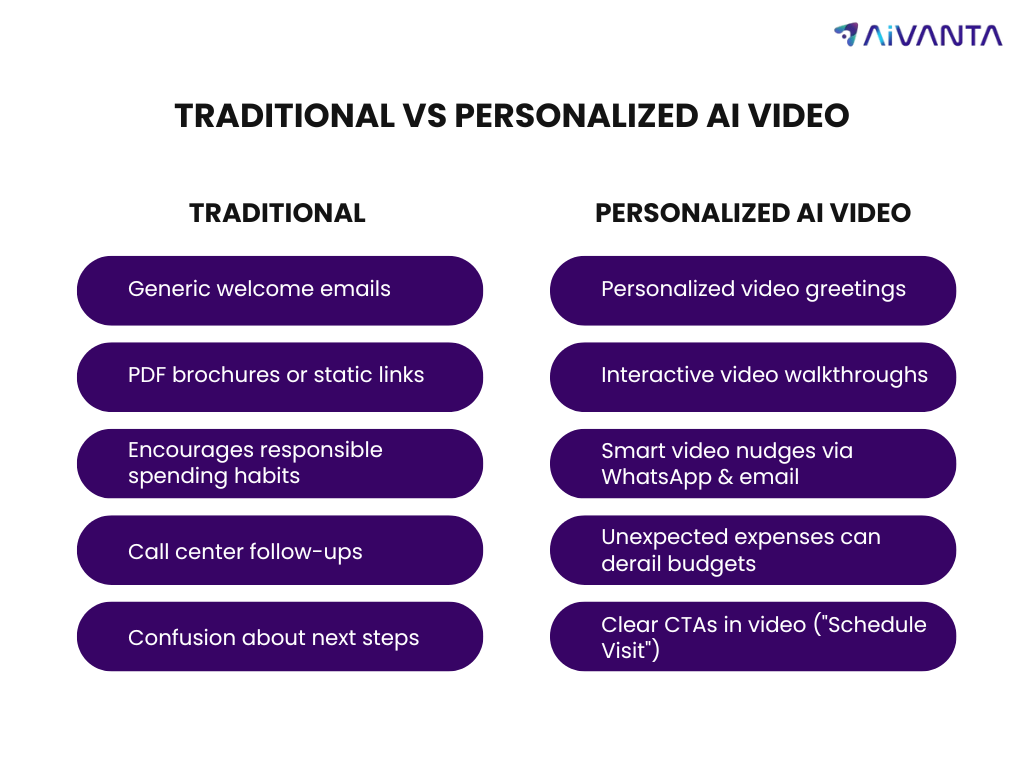

Old methods like long emails and hard-to-read statements don’t work well today. Personalized AI video helps banks explain things clearly, visually, and in a friendly way, essential factors in building customer trust.

When people feel understood and respected, they are more likely to use additional services and speak positively about their bank. Since banking services are often quite similar, delivering a better customer experience is a key to retaining customers and growing your business.

What Role Do Personalized AI Videos Play in Banking?

Personalized AI video offers a new way for banks to connect with customers. Instead of sending plain text messages, banks can now send video summaries of bank statements, investment updates, or product tips customized for each person. These videos greet customers by name and explain things using pictures, voiceovers, and clickable elements.

With an AI Video Generator, banks can make these videos while still following all the rules and keeping data safe. That way, customers get messages that are useful, easy to understand, and simple to act on. The videos will be interactive; hence, customers will be more engaged.

How Can Personalized Video Messages Boost Customer Engagement?

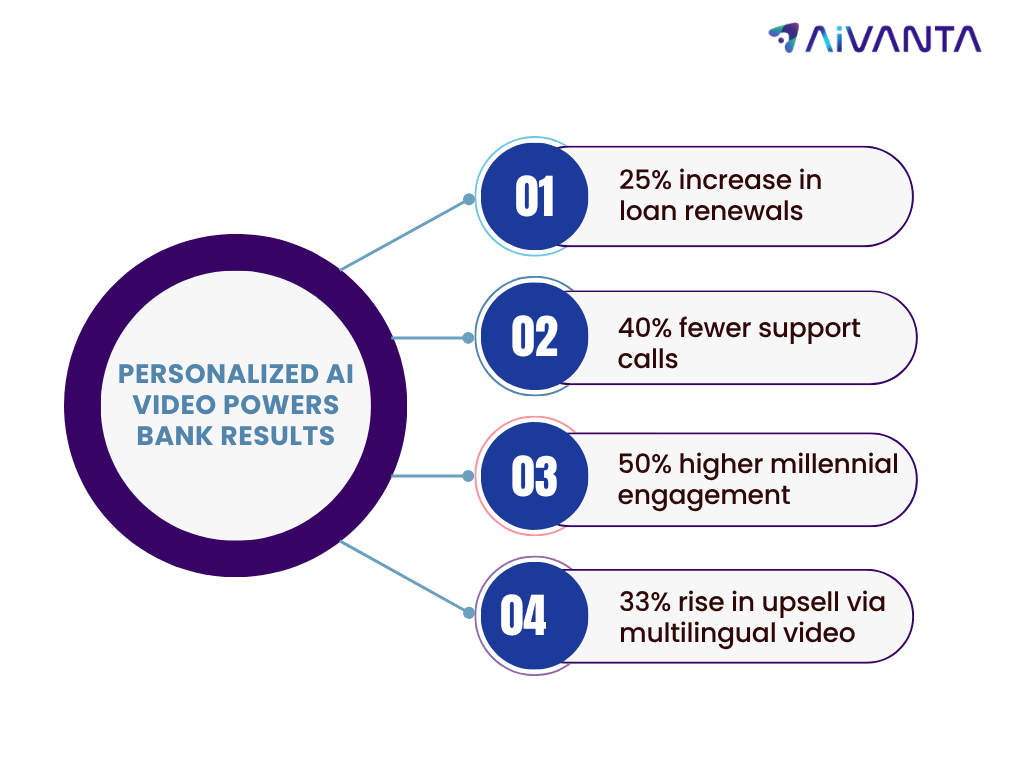

Banks that use personalized AI video messages see a big jump in customer activity. Whether helping someone open a savings account or showing credit card users their new benefits, video makes the experience more personal, easier to understand, and more two-way with clickable buttons. Additionally, it improves the customer engagement experience and gives people more confidence in their choices.

Video messages also get people to take action. For instance, a reminder video about a fixed deposit that is about to end can include options to renew with easy click-to-act buttons. This makes the customer happy and creates new chances to earn money.

Why Is This Communication Format More Effective Than Traditional Channels?

Individuals are getting a response to video as opposed to plain text. Online video communication allows banks to describe everything more clearly using pictures, create a connection by telling a story, and show a customer the next step. Individuals tend to view a video message than respond to an email message or look at a dashboard. This results in improved use of services, increased upgrading and brand loyalty.

It seems more personal to view a video recorded message on a special occasion or alert about something essential than to read an ordinary text message. These little gestures, in the long term, allow people to trust and feel that the bank cares.

How Does This Approach Improve Monthly Statements and Reporting?

Bank statements are often full of confusing terms and tables. Personalized AI videos turn those statements into easy-to-follow video summaries. A customer can now watch a video that shows how they’ve spent money, and offers saving tips. Online video communication makes it possible to do this on a large scale and at a low cost, helping customers feel informed and satisfied.

Instead of trying to understand numbers, customers get a clear overview that teaches them about their money. Also, it helps them learn more about finances and avoid misunderstandings, leading to more intelligent decisions.

How Do Scalable AI Solutions Support Banking Teams?

Creating a personalized video for every customer might sound difficult, but not with scalable AI solutions. CRM and bank account information can be used to generate videos based on customer behaviours, requirements, and life cycles in the banking process. Whether a welcome video for a new user or a service renewal message, AI will ensure that the right message is sent at the right time.

Such an automation is also useful in making marketing, sales and customer service teams more cooperative. Everyone will be able to send identical messages without the necessity of making hand follow-ups. This simplifies the work of customer service departments, accelerates responses and enables the banks to relate more intimately with customers across the board, whether new account holders or those of high value. Every customer gets a message that feels made just for them.

What Real Results Have Banks Seen with Personalized AI Video?

How Can Banks Start Implementing AI Video Solutions?

To get started with AI video, banks need three main things: a video communication platform that can safely create and send personalized video messages, account and customer data to personalize those messages, and a clear plan that shows where videos will be most helpful. Video works across the whole customer journey, whether it's for welcoming new users, keeping customers, encouraging upgrades, or teaching about money, meets all the privacy and security needs of highly regulated industries.

Conclusion

The customer experience in banking today goes beyond just fixing problems. It’s about being there for customers with clear, helpful, and personal service. By videos, banks connect with customers, turning everyday messages to build genuine relationships. As the world becomes more digital, banks that focus on better customer experiences using video will gain more business, and build loyalty that lasts.

Want to change the way your bank talks to customers? Request a demo and see how personalized AI video can power your digital strategy.