How Can Personalized AI Video Boost Banking Lead Generation?

Published on 2025-06-13

As the banking environment becomes overwhelmed with digital channel leads, content that differentiates and provides value must be used to nurture leads. AI-driven personalization technologies have the ability to browse history, intent signals, and demographic information and present customers with videos that will help them feel understood, heard, and prioritized.

Be it a warm introduction of a new inquiry using an explainer video or following up on incomplete applications, banks can make all the touchpoints contextual. Personalized AI videos can increase not only the open rates but the trust at the very first contact-establishing the foundation of higher conversions and lifelong relationships. The old lead funnels (long forms, follow-up calls, and template emails) are not enough in a world where the customers expect transparency and immediate value.

What Role Does Personalized AI Video Play in Lead Conversion?

Personalized AI video has changed the banking industry in the way of engagement with potential customers. These videos address the needs, preferences, and intent of the prospect since they transform data points into motion graphics, animations, and other dynamic and interesting content. Consider a lead that has made an inquiry on a home loan. They do not get a text-based email; rather, they get a personalized video indicating the available mortgage plans, detailing the benefits, dissecting EMIs, and even suggesting the next steps, all of which is based on their profile.

This approach accelerates trust, improves understanding, and reduces drop-off. Leads feel like they’re in control of their decision-making process, and banks establish themselves as transparent, tech-forward partners.

How Does AI Improve the Banking Customer Experience from the First Touchpoint?

A great banking customer experience starts with how prospects are treated during the lead generation phase. AI enables banks to:

- Personalize content based on CRM insights and behavior analytics

- Time interactions based on user engagement

- Adapt language and visuals to the customer's location, device, and preferences

This method speeds up trust, increases comprehension and decreases drop-off. Leads get a sense that they are in charge of the decision-making process, and banks introduce themselves as transparent and tech-savvy partners.

Also Read: Indian Bank Grows ULIP Conversions by 18% with Persona-Based Education Videos

Why Are Video Communication Platforms Essential in Modern Banking?

A robust video communication platform allows banks to go beyond static interactions. Video simplifies complexity, humanizes content, and increases comprehension especially when discussing financial products.

Engage clients with personalized ai videos:

Video content is more likely to be consumed, remembered, and acted upon. It’s the bridge between data-driven insight and customer-facing impact.

How Does Personalization Increase Relevance and Retention?

Generic messages get ignored. Personalized AI video messages for customer engagement capture attention, increase session times, and drive action. A potential customer is more likely to react well when it recognizes the name, details of the inquiry and the content that is actually relevant to them.

Personalization also reduces confusion which is a major friction point in the conversion of banking leads. It could be breaking down interest rates or assisting a customer in comparing two loans, but regardless, personalized video keeps otherwise confusing topics simple, which creates confidence and advances prospects through the funnel.

What Makes Multilingual Client Interactions a Game-Changer?

Banking is a deeply personal topic, and customers feel more comfortable when information is presented in their preferred language. With multilingual client interactions.

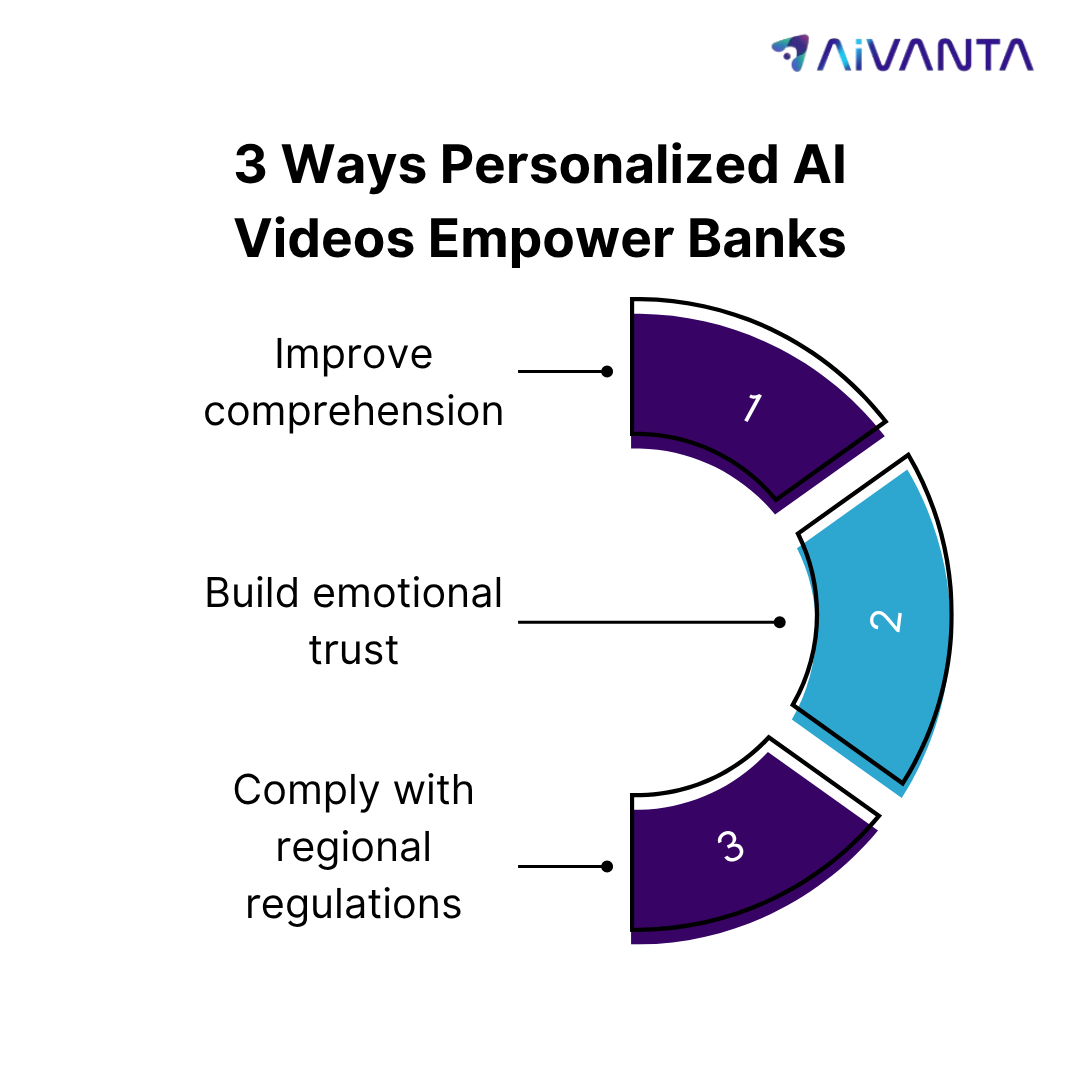

Banks Empowered by Personalized AI Video:

Localized videos increase inclusivity and help financial institutions reach wider demographics, essential for growing in diverse and multilingual markets.

Real-World Impact: Personalized AI Video in Banking

One national bank implemented personalized AI videos for new credit card enquiries and reported a 25% reduction in churn within the first month. Another regional lender used video follow-ups for mortgage leads and saw an improvement in their Net Promoter Score (NPS) by 18 points. These numbers underscore how AI doesn't just generate leads; it builds lasting relationships.

These aren’t hypothetical outcomes; they represent a shift in how banks attract, nurture, and convert leads. Customers respond to relevance, clarity, and timeliness and AI makes that possible.

Conclusion

Personalized video is no longer a luxury; it's a necessity for modern customer acquisition and conversion. Now is the time to reimagine your banking lead strategy with AI-driven personalization that speaks directly to your prospects and earns their trust from the very first click. Ready to future-proof your lead pipeline? AiVANTA helps banks optimize banking lead generation using personalized, automated, and multilingual video solutions. Request a demo and explore how we can enhance your lead generation strategy through personalized video engagement.